Your fast money brain will make you lose everything

I bought my first Bitcoin in 2013.

As someone who's survived enough cycles and pain to still be standing in 2026, I’ve seen every possible way crypto can make or break a person.

After 13 years, one thing becomes impossible to ignore:

In crypto, “winning” isn’t making money.

Everyone has made money at least once.

Winning is making money and still having it years later.

Yet almost everyone fails that test.

Most people eventually get wiped out. Only a small handful survive cycle after cycle. Even fewer manage to preserve and grow their capital.

So this article is about the WHY, HOW, and WHAT

To understand that, you’ll need to unlearn how most people think about crypto.

This article briefly touches on crypto’s history and philosophies. It’s also the part most people don’t bother investing time in because it doesn’t feel immediately profitable.

But in my experience, ironically, that’s often one of the key differences between people who survive cycles and people who don’t.

"The only true wisdom is in knowing you know nothing."

— Socrates

So I will answer these questions by breaking down:

I. What actually pulls crypto out of stagnation, how to spot a real regime shift vs a “fake revival”, plus 3 case studies and a practical checklist you can use as a reference.

II. How to increase your odds of finding "the next big thing" by upgrading how fast you learn, filter noise, and stay alive in chaos.

III. What those who survived devastating cycles have in common, allowing them to keep compounding while everyone else burns out.

If you’ve ever made money in crypto and still lost it later, this is for you.

I. The Crypto Stagnation Killer

When people ask why crypto feels dead, it’s always the same recycled excuses.

"Institutions haven’t fully entered!"

"It's those damn market makers and KOLs!"

"The next big tech upgrade hasn’t arrived yet!""

"No no trust me, we just need a new narrative!"

"It’s because THIS and THAT company/project/exchange f*cked up!"

Sure, those things suck. But solving them doesn't end a crypto winter.

If you’ve lived through enough cycles, you realize a pattern:

Crypto never revives by becoming more like the old system. It revives by reminding us why the old system is broken.

Stagnation isn't just a "liquidity problem" or a lack of code updates. It’s a coordination problem.

You know you’re in the middle of a dead zone when three things break at the same time:

1. Capital is bored.

2. Attention is exhausted.

3. The Coordination Primitive is broken (I’ll explain what this is later).

In such scenarios, price stays weak not because crypto is “dead,” but because there is no new reason for new participants to coordinate around it.

This is where most people get confused.

They think the next cycle will be triggered by a shiny new product, a "killer feature," or a hot narrative.

But those are outcomes, not causes.

A "buy" button or a faster chain doesn't start a movement. They only become visible after something deeper has already shifted in the way we choose to coordinate.

If you don’t understand that underlying logic, you’ll always be distracted by noise and become the easiest target for scammy shillers pushing whatever they’re holding.

— Me, as someone who's been rugged at least 2942 times over the past 10+ years.

That’s why so many people keep chasing the “next big thing,” only to realize they entered too late or, worse, backed the wrong one.

If you actually want to train an "investment sense" that spots a real play before you get dumped on at TGE, stop looking at charts for a second.

You need to master one brutal distinction first.

The Secret Sauce: Consensus vs. Narrative

Because in reality, what pulls crypto out of stagnation is always the same thing: a consensus upgrade.

In this space, consensus means a new way for humans to financialize and coordinate around an abstract element (such as belief, judgment, identity, etc.) using crypto as the medium.

And consensus is not the same as narrative.

This is where people constantly get it mixed.

Narrative is a shared story.

It’s the "talk."

It attracts the attention.

Consensus is shared behavior.

It’s the "organization."

It keeps people there.

Narrative without behavior → short hype

Behavior without narrative → silent adoption

Both together → real cycle ignition

To see the difference clearly, you need to zoom out.

So let’s do a brief history lesson

You’ll see that underneath the narratives, it’s all about aggregation, and that’s consensus.

Crypto is a giant game of "let’s see how many people we can get to do the same thing at once." That’s what consensus actually is.

Brief timeline of "Real Regime Shifts"

Back in 2017, the ICO was the ultimate coordination hack. We aggregated funding and faith. We basically said: "I have a PDF and a dream, who’s in?"

Then, countless people who didn't know each other concentrated their money and attention into one spot. It was messy but it worked.

Next, IDOs came along and turned that into a ritual. No gatekeepers, just a permissionless "vibes check" on a DEX.

Then came 2020 DeFi Summer. This wasn't just money anymore. This was financial labor. We were the back-office of a bank that never sleeps. Lending, borrowing, swapping, and hunting for 3,000% APY while praying nothing blew up while we slept.

Then 2021 NFTs hit and everyone went "Wait, why am I buying a JPEG?" But we weren't buying a picture. We were buying culture.

We were aggregating into tribes. Your profile pic was your passport. It was a digital "I’m with these guys" badge that let you into the gated Discords and exclusive parties.

With 2024 Memecoins, the system barely cared about technology anymore. What it was really aggregating was emotion, identity, and collective inside jokes.

You weren’t buying a whitepaper anymore.

You were buying for a “Yea I know this vibe. And you know why I’m laughing/crying hehe.” You were buying for a "community" that made you feel less alone while your portfolio was down 80%.

Now, we got Prediction Markets. What are we aggregating here? Judgment. Shared beliefs about the future.

Look at the U.S. elections. The whole world is watching but most of us can't vote. With a prediction market, you still can’t vote, but you can stake your judgment.

You’re telling the world: "I’m so sure this will happen that I’ll bet my stack on it." Crypto isn't just moving money anymore. It's redistributing the power to be right.

Zoom out far enough and the pattern is clear.

With every cycle, a new dimension gets pulled into the system:

money → faith → financial labor → culture → emotion → identity → judgment → and ____ ?

Once you see this, you can’t miss it.

Every time crypto expands beyond its niche, it does so by gathering people in a new way. Each cycle doesn't just add more people. It adds a new reason to stay.

That’s the secret.

The token was never the point. It’s just the campfire we sit around. Something for us to poke at and play with.

What’s actually moving through the pipes isn't "money." It's us, learning how to agree on bigger and bigger things without a boss in the room.

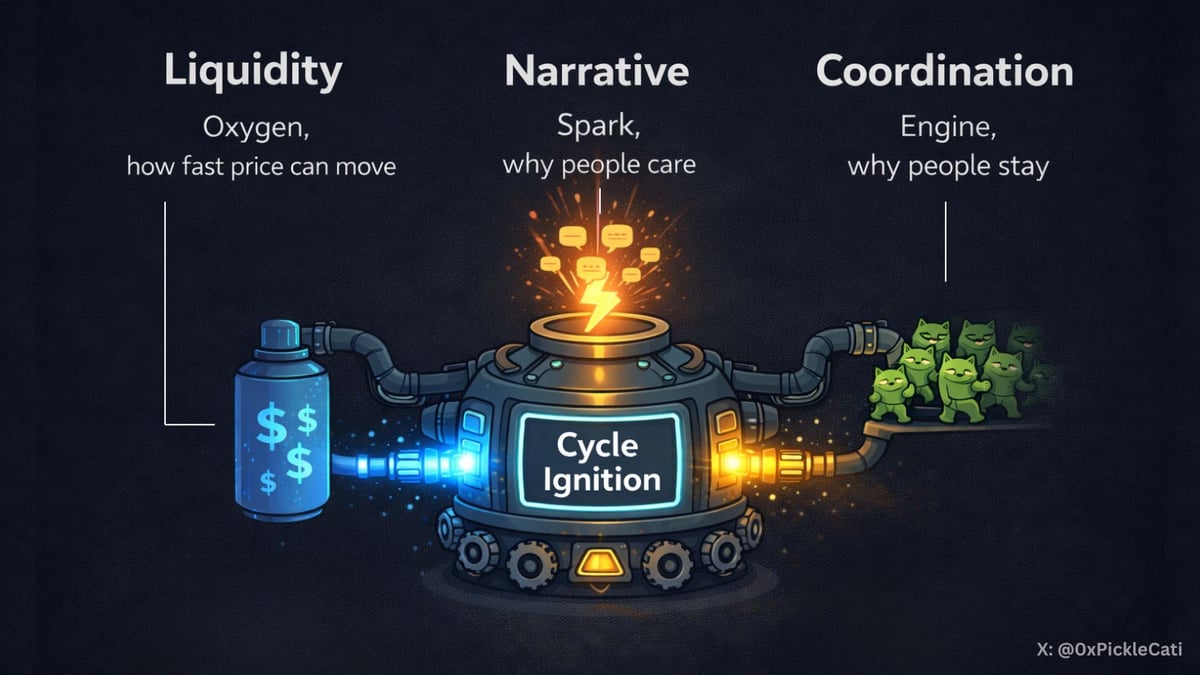

A useful way to better understand this is through a simple three-fuel model.

Liquidity is the oxygen (macro stuff like the dollar's strength, the leverage, and how much "gambling money" is sloshing around). It determines how fast price can move.

Narrative is the spark (why people care, how it gets explained, shared language). It determines how many people look.

Coordination Primitives are the engine (shared behaviors, repeated actions, ways people coordinate without a central authority). It determines who stays when price stops rewarding them.

Liquidity can pump a price and Narrative can pump a vibe. But only a new Coordination Primitive gives people a new way to act together beyond just buying and selling.

This is why so many crypto “revivals” fail.

They have liquidity. They have a story.

But nothing changes in how people actually coordinate.

So how do you tell the difference between a fake revival and a real regime shift?

Stop watching the charts and start watching the behavior. Real regimes don't just pump your bags. They change how we act together.

Even though they don't last forever, they last long enough to define a phase of the cycle and drag crypto out of its last stagnation.

If you want to actually put these into application and spot the next big thing yourself, reading theory isn't enough. You need to study crypto history first.

This next section is broken into 4 parts: 3 case studies to show how past trends evolved, and a basic checklist to help you figure out if a new narrative has staying power or is just a flash in the pan.

Case Study 1: 2017 ICO Boom vs Early Experiments

Price of BTC and ETH during ICO mania (mid 2017 - mid 2018)

It was the first time crypto figured out how to coordinate people and capital at global scale. Billions of dollars flowed on-chain, not into finished products, but into "ideas."

Before that, there were early experiments. Mastercoin in 2013. Ethereum’s own sale in 2014. Interesting, but niche. They didn’t yet create a shared, global behavior that sucks everyone into the same orbit.

For most of crypto’s early years, the playbook was simple:

you mined it, traded it, held it, used it to buy things (like on the darknet).

Sure, there were plenty of "get rich quick" ponzis, but we didn't have a standard way for a bunch of strangers to collectively fund a dream on-chain.

The DAO in 2016 was the first real "aha!" moment. It proved that a bunch of people who didn’t know each other could pool their money using nothing but code.

But let's be real... The tools were clunky, the tech was fragile, and it eventually got hacked into oblivion. The behavior appeared, but it wasn’t repeatable.

Then came 2017, and everything became repeatable.

Ethereum and the (now more mature) ERC-20 standard turned token launches into a factory process. Suddenly, the "default" way to be in crypto had a revolution.

That new "trending" behavior onboarded millions of people and fueled a massive bull market. But more importantly, it permanently reshaped the DNA of crypto.

Even after the crash, we never went back to the "old way." The idea that anyone, anywhere, could fund a protocol had officially stuck.

Yes, a lot of those ICOs were total scams or "ponzis." We had those before 2017 and still have them now. But the behavior, the way we coordinate and move capital, was forever different.

That’s what a real regime shift looks like.

Case Study 2: 2020 DeFi Summer vs Fake Revivals

Price of BTC and ETH during DeFi Summer (June 2020 - Sep 2020)

This was also a real regime shift because people started using crypto like "finance" even when price wasn’t blasting off, unlike the ICO era where price acceleration and behavior fed off each other.

Before 2020, outside of ICO season, the crypto experience was basically "buy, hold, trade, and pray."

(well, unless you were a miner… or doing something you probably don’t want to explain👀)

Now, people developed on-chain muscle memory, changing the industry forever. We learned how to:

During DeFi Summer, the ecosystem felt "alive" even when Ethereum and Bitcoin prices went sideways. Activity didn't require a straight-line pump.

It broke the "casino-only" mindset because, for the first time, crypto felt like a productive financial system instead of just a speculative toy.

Compound ($COMP), Uniswap ($UNI), Yearn Finance ($YFI), Aave ($AAVE), Curve ($CRV), Synthetix ($SNX), and MakerDAO ($MKR/$DAI) were among the DeFi projects that became the "internet's banks."

Even wild experiments like SushiSwap mattered. Its “vampire attack” literally sucked liquidity out of Uniswap and proved incentives could move capital on command.

Then... what followed were fake revivals.

Such as the swarm of copycat farms with food names like Pasta, Spaghetti, and Kimchi. They didn't add new coordination behavior and most of them vanished as fast as they appeared.

By 2021, DeFi was still very much alive (with protocols like dYdX and PancakeSwap growing fast), but the wild part was over and the crowd had already moved on to the next shiny thing (NFTs).

Looking back from today (2026), you can see that 2020 was the actual birth of the "on-chain economy." Almost everything we do now, from Airdrop points and TVL-chasing to L2 incentive campaigns, borrows from the 2020 playbook.

After DeFi Summer, it got much harder for a new product to matter without a functional reason for people to stay on-chain.

Incentives can spike activity, but if those rewards aren't building a permanent coordination habit (a new primitive), the project is just a ghost town waiting to happen the moment the payouts stop.

Case Study 3: 2021 NFTs Flipping The Social Script

Price of BTC and ETH during the NFT mania (early 2021 to mid 2022). 2021 was a perfect storm where macro stimulus, institutions, NFTs, DeFi growth, L1 wars, etc. all hit at once. This case study focuses on NFTs, one of the biggest catalysts of that cycle.

While DeFi Summer was about nerding out over liquidity curves, 2021 was the year crypto finally got a personality. We stopped optimizing for yield and started optimizing for vibes, identity, and tribalism.

For the first time, digital items weren't just copy-pasteable "stuff." They had Provable Provenance. You weren't just "buying a picture." You were buying the digital receipt that said you owned the original, and the blockchain was your witness.

This flipped the social script. People weren’t trying to out-math each other anymore. They were flexing.

You now got profile pics as passports. Owning a CryptoPunk or a Bored Ape (BAYC) became a digital "proof of alignment." Your avatar was no longer a photo of your cat. It was your entry ticket into an elite global circle.

Now there's gated access. Your wallet became your membership card. If you didn’t have the right assets, you weren't getting into the private Discord, the underground parties, or the exclusive airdrops.

And wow, IP ownership. BAYC changed the game by letting holders own the commercial rights. Suddenly, strangers were coordinating to build merch, music, and streetwear around their Apes.

Most importantly, it onboarded the "Normies."

Artists, gamers, and creators who didn’t care about APY or liquidation math suddenly found a reason to own a wallet.

Crypto wasn't just finance anymore. It was the internet’s native culture layer.

In terms of coordination primitives:

And of course, the fake revivals...

First we got the "copy-paste" wave.

Once the "Ape" blueprint was proven, the copycats crawled out of the woodwork. They had the story, but zero soul. Countless lookalike collections launched that were basically “Bored Apes but it’s a hamster,” promising fairytales for roadmaps. Most became ghost clubs. Or, you can also say: ghost towns with a floor price.

Next we got the "wash trading" mania.

Sites like LooksRare and X2Y2 tried to force "DeFi logic" onto NFTs by paying people to trade with themselves. It looked like a revival, but it was just bots farming rewards while real humans had already left the chat.

Last but not least, we got the "celebrity cash-grabs."

Almost every celebrity launched a collection because their manager told them it was a "new ATM." Since there was no real coordination or community behind them, these projects died faster than a TikTok trend.

And the lesson?

Just like the ICO and DeFi Summer eras, the NFT bubble popped. But the behavioral residue was permanent and it lasted long enough to permanently change the industry.

Crypto stopped being just a digital bank and became the internet’s native culture layer. We stopped asking "Why own a JPEG?" and started understanding provable provenance.

For example:

The coordination habit stuck. We learned to belong to digital tribes, and we’re never going back to just being "users" again.

What You Can Do Now To Practice

Up till now, we have covered 1/3 of this article and I already gave you 3 case studies of how to identify fake revivals from real regime shifts.

And I could talk all day about Memecoins and Prediction Markets but I’m going to leave those for you to "diary" yourself.

Also, it’s a good idea to study “failed” narratives and “failed” consensus upgrades, including, but not limited to: 2021-2022 Metaverse 1.0, 2023-2024 SocialFi 1.0, etc.

They might feel like ghost towns now, but they are actually stepping stones. Real shifts rarely happen overnight. Look at ICOs: the first one happened in 2013 with Mastercoin, but it took 4 years of trial and error before 2017 actually changed the world.

The next big breakthrough might be something entirely new, or it could be a historically “failed” idea reviving in a new form. If you’ve done the work while everyone else was looking away, it’ll become your opportunity to catch.

There’s no shortcut here, the only way to sharpen your “investor’s gut” is to get your hands dirty and do the actual work and active reflection.

Ask yourself what people are actually doing. If you can’t see the behavior change then you’ll never spot the shift. Am I right or am I right?

Here's also a basic checklist for you to identify signals for “if another regime shift is coming.” I call this the "Exit Liquidity Filter".

1. Are non-mercenaries arriving?

You see people showing up who aren't just there to flip a token. They are creators or builders or people seeking identity. If the only person in the room is a trader then the room is actually empty.

(If you're a trader and you're reading this, well, I'm a trader too. You know we need more than just us to keep the lights on.)

2. Does it pass the incentive filter?

Watch what happens when the rewards dry up or the price goes flat. If people stay then you have a habit. If they vanish the moment the free money stops then you just have a ghost town.

3. Are they choosing routines over positions?

Beginners watch their portfolio but winners watch what people are doing every morning. If they are building daily habits around the system then it’s a permanent coordination primitive.

4. Is there behavior over polish?

Real shifts happen when the tools are still broken and ugly. If people fight through a terrible UI to participate then the behavior is real. By the time the app is polished you are already late.

5. (Most important!!) Is there emotional defense?

This is a big one. When people start defending a system because it’s part of who they are and not just because they’ll lose money then the shift is complete.

If you only focus only on the price then that’s why you’re never early. Big green candles come because the behavior has changed months ago.

Price is just the laggy indicator that finally admits the world has moved on.

II. If you can't 1000x your bags, at least you can first 10x your learning speed

I know what you’re thinking now.

"Okay, I get the underlying logic now. Regime shifts. Behavior changes. Coordination primitives. I understand what to look for in theory.

But when the next regime shift actually hits, it’s both chaos and a huge cluster of opportunities...

So how the hell do I SPECIFICALLY find the 1000x ones under all that noise? And more importantly, how do I get in early, before everything starts pumping?"

Honestly? You’ve just asked the million-dollar question. Literally.

And if anyone looks you in the eye and gives you an "absolute" 5-step formula, they're either trying to get you to buy something or sell you a $997 masterclass.

Why? Because every new cycle is a brand-new coordination game.

You can’t take your 2020 DeFi Summer playbook and expect it to help you pick which memes will rip in 2024/2025. And even if you’re a killer meme trader today, that doesn't guarantee you'll absolutely crush prediction markets in 2026.

(unless your last name is Trump. Then... congrats on being no.1 in both😅)

You can’t predict the future, but you can at least build a solid foundation or framework. So when the next big thing actually hits, you can wrap your head around it 10x faster than the rest of the crowd.

Every cycle survivor I know has this trait. It doesn’t guarantee you’ll make more money than last time, but it gives you a massive head start over the newcomers who are just here to gamble.

The framework has three pillars: the underlying logic of crypto cycles, your crypto knowledge structure, and your value anchoring system.

We already covered the first part. Now let’s get into the second, which is, in simple terms: "What on earth should I be learning, and how do I actually learn it?"

So, below are two of my personal suggestions to help you with answering "your" part of this question.

Advice 1: Furiously upgrade your "internet detective" skillset

You will NEED to have at least the skills below. Everything here is 100% learnable online for free. No paid courses or “guru” mentorships required. But you will need to pay with your own commitment and time.

First, learn on-chain forensics to identify an orchestrated mass-sniping event or you will be the exit liquidity. You should be comfortable reading wallet histories, holder distribution, bundling, funding paths, and spotting suspicious on-chain behavior.

Second, understand market mechanics to anticipate supply shocks and avoid violent liquidation squeezes before the chart snaps: order book depth, bid-ask spreads, exchange net flows, token unlocks and vesting schedule, market cap to TVL ratio, open interest, funding rates, macro flows, etc.

Next, if you don't want to crushed in the "dark forest", learn how MEV works or you'll get "sandwiched" without even realizing it (speaking from pain😢).

If you are committed to dig deeper and get ahead of people around you, learn how to recognize fake volume, wash trading, incentive farming, "low-float/high-FDV" trap, and how Sybil resistance works if you’re farming airdrops.

Last but not least, you should be able to automate parts of your news filtering, signal tracking, trading strategy, and noise reduction. "Vibe coding" and LLMs have made it super easy for anyone to build lightweight bots or AI agents.

As of 2026, almost everyone I know, even those with zero coding background, is building custom tools to filter the noise. So if you're still "manually scrolling", that's probably one reason why you're always late.

If you don't commit to building this foundation, you’re choosing the "hard way." That means getting scammed, rugged, and drained until you finally get angry enough to learn.

I know, because I did it. Scammed by strangers and friends alike, fell for ponzis, honeypots, backdoor contracts, drained wallets, OTC scams, and even social engineering attacks. That’s not even counting the 3 times I got liquidated.

Besides the technicals, here are some MORE tips and tricks on the "social" side you can immediately use to filter out red flags.

This starts simple. Has the project’s official account changed usernames 10+ times? Were past handles tied to sketchy abandoned projects? There are plenty of tools that show an account’s username history. Use them.

Before you invest, check if the team even exist. Do the founders and core team members have X, LinkedIn, GitHub?

If they say they worked at a reputable company or went to a top school, actually check. Fake Stanford, Berkeley, and fake ex Meta, Google, Morgan Stanley backgrounds are way more common than people think.

Same goes for “VC-backed,” “incubated by,” or “partnered with” claims. Some “investors” never invested, and some “partners” are just indirect advisors who let the team use their logo. This happens more often than you’d expect. I’ve seen it firsthand.

And with AI flooding everything now, fake engagement is the new norm. You must learn to spot "off" follower-to-engagement ratios and recognize AI-generated chatter in Discord, Telegram, and X.

If you can’t do all the things above yet, at least you know where to start.

Advice 2: "Go undercover" but in a genuine sense

To be honest, you just need to know people. In crypto, as in finance or any other industry, your network is your ultimate hack.

I could write a "50 things checklist" on how to research projects, but that’s LinkedIn-tier garbage. Why?

Because real alpha is never shared publicly when it’s has first-hand edge.

By the time a project hits your public feed, you might still make a profit, but it wouldn't be the "1000x life-changing money" you came to crypto for. The "best entry" window has already slammed shut.

This is why most newcomers every cycle become exit liquidity. They act on "late-to-late" information filtered through private circles first.

So if you don't have an (or multiple) insider line yet, position allocation is your only safety net. Keep the bulk of your capital in long-term plays.

These have a lower "information bar" and less soul-crushing time pressure, giving you the breathing room to research public data without needing to be the first person in the room. If any of those projects can survive just 1.5 cycles, you’ll hit multiple profit waves regardless of your entry.

However, your long-term goal is to stop being a spectator and start being a peer. To do that, you need chips in your hand. Outside of your family, the world is interest-aligned. The people you admire don’t exchange first-hand insights with someone who can’t give value back.

You need to be "someone" or have "something" valuable to exchange, whether that’s specialized knowledge, boots-on-the-ground research, money, or connections. Nobody is an expert in everything, and that creates opportunities you can grab onto.

The best way to do this is to go "undercover" in an ecosystem, and do it genuinely.

First, get a job at a project within the sector you're targeting. Whether you’re a developer, a marketer, or a BD, working "inside the tent" is the fastest way to build a reputation and meet the people you want.

Obviously, just having an entry-level crypto job won't immediately give you everything you want, but it's a good start.

"But what if I lack the experience to land a solid crypto job?"

The good news: in 2026, crypto still isn't a corporate desert like TradFi or Big Tech. You don't need a two degrees and a stack of elite internships just to get an interview.

In this industry, your on-chain history is your resume. If you’ve spent an insane amount of time experimenting, degen-ing, and actually doing stuff, you already have more relevant experience than most "corporate folks" pivoting into the space.

Other paths to build your crypto network:

There’s no such thing as a free lunch or a reliable shortcut. Giving 100% doesn't guarantee a 100% success, but giving 0% definitely guarantees a 100% failure (well, unless you're Barron Trump, anyway).

III. The secret to staying in the game long enough to win

Based on the people I know, those who survive multiple devastating cycles and still manage to build wealth have another two things in common:

First, to be clear, conviction is NOT stubbornness or blind faith.

It’s actually NOT “never selling no matter what.”

Real conviction is structural. And structure includes flexibility. You can have massive conviction and still take some profits or rebalance your pie.

The difference is that you ALWAYS and CONSISTENTLY come back.

You don't leave the room just because the music stopped. Your reason for being there was never just about the green candles in the first place. It was about the fundamental "Why."

People who survive cycles don’t ask: “Is this going up soon?”

They ask: “Does this STILL make sense even if the price stays 'wrong' for the next few years?”

That distinction is everything.

"Fast-money" thinking doesn't just empty your wallet.

It rots your conviction and destroys your belief system.

And belief is much harder to rebuild than capital.

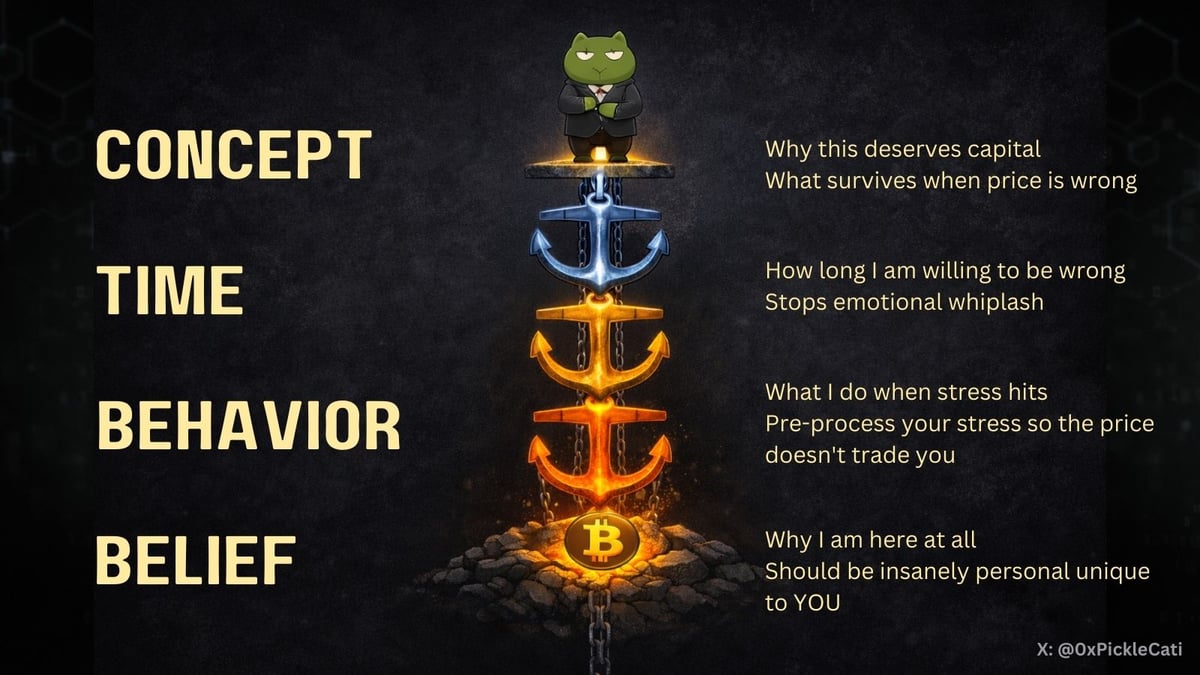

What's that "multi-layer anchor system" they all have and how can you build yours?

1. Concept Anchor

Stop looking at the ticker symbol and start looking at the principle. Ask yourself: “What makes this worth holding even if the price is in the dirt?”

Think about the last 10 tokens you traded. Now, fast-forward two years. Ask yourself: How many of those will still 'exist?' How many will actually still matter?

If you can’t look at a project and explain why it deserves long-term capital without mentioning "the community" or "the moon," you don’t have conviction. You just have a position.

2. Time Anchor

Most people don’t know what game they’re playing and their decisions are easily manipulated by crowd sentiment.

That’s not a strategy. That’s emotional whiplash.

I’ve met people who made money doing that, but I’ve met exactly zero who still had that money two months later. All they had left was +99999% in emotional damage.

The real issue is playing multiple incompatible games at the same time.

Short-term speculation, mid-term positioning, and long-term accumulation each demand completely different behavior.

And people who survive cycles know exactly which timeframe each position belongs to, and they do not emotionally leak behavior across them.

They don’t use short-term price noise to invalidate long-term beliefs, and they don't use long-term narratives to justify impulsive short-term trades.

If you’re transitioning from day trading to swing trading, this is where most people quietly sabotage themselves.

Common mistakes include:

You think you’ve changed strategies, but your behavior hasn’t caught up yet. You’re essentially trying to run a marathon with a sprinter’s mindset.

The Time Anchor stops this cycle by forcing you to answer one uncomfortable question before you ever hit "buy":

“How long am I actually willing to be wrong?”

3. Behavior Anchor

It’s easy to say you believe in something when the sun is shining. It’s a lot harder when your pnl is deep in the red and your nervous system is screaming at you to "do something."

You need a framework of questions that predict YOU, not the market.

Before you enter a trade, you need to run through a checklist to see if your future self is going to sabotage your current plan.

Do I already know whether I will do nothing, reduce, or exit?

During a drawdown, am I objectively re-evaluating the thesis, or am I subconsciously sourcing information that justifies a panic sell?

When price +x%, do I often get greedy and move my take-profits higher because I'm "feeling it"?

If I choose not to sell into strength, can I clearly explain why without only referencing sentiment or hype?

When a position goes sideways longer than expected, do I often hold it because the thesis still holds, or because I’m too proud to admit I made a mistake?

When I break a rule, do I notice it and take action immediately, or only after pnl turns against me?

After a loss, do I immediately feel the itch to jump into something else just to "get it back"?

The point of these questions isn't to guess where the chart goes. It’s to map out how you’ll react when the pressure is on.

A Behavior Anchor is about pre-processing your stress. By deciding your moves while you're calm, you protect yourself from making them when you’re desperate.

If you don’t have a plan to trade the price, eventually, the price will start trading you.

4. Belief Anchor

Have you realized the people who leave crypto the fastest are almost never the quiet ones? They’re usually the loudest voices in the room during the bull market.

"This is your LAST CHANCE to buy x."

“This is the last time Bitcoin will go below 100k!”

“If you aren’t all in on [new narrative], you’re literally betting against the future of the internet.”

Then, the price turns, they vanish. Their "conviction" evaporates as if it never existed in the first place.

The "get-rich-quick" mindset doesn't just wreck your portfolio through over-trading. It rots your belief system. And a shattered belief system is much harder to rebuild than a bank account.

"Easy money will always attract wretched excess. It's nature, just like African animals feeding on carcasses."

— Charlie Munger

The tragedy is that most people burn their capital when the hype is high, leaving them with no "bullets" left when the real opportunity (the real bear market) finally arrives.

It’s a brutal irony: the very mindset that brings people into crypto (the hunger for a quick win) is exactly what kills their long-term chance at generational wealth.

Most won't even realize what they lost until years later when Bitcoin multiplies again and they’re left asking, “Why the hell did I walk away so early?”

This is why the Belief Anchor is the most important one. It’s a deep mental foundation that takes years to harden.

How do you know if yours is strong enough?

Try this: If someone aggressively challenges your position right now, can you calmly defend it? Are you able to welcome hard questions instead of avoiding them?

Your belief system should be insanely personal and unique to YOU.

For some, it’s cypherpunk ethics:

A flat-out rejection of surveillance and centralized control. To them, crypto isn't just an investment. It's an exit ramp from a broken system.

For others, it’s monetary history:

They see the cycles of debasement and financial repression and recognize that crypto is the only logical hedge against a legacy system that breaks the same way every century.

For certain believers, it’s sovereignty, neutrality, or survival.

You have to find your own "Why" instead of just renting the conviction of an influencer. I can’t tell you what your anchor should be, but I can share mine.

Last year, back when I only had 2,000 followers and nobody really cared what I had to say, I wrote a post answering one simple question:

Why, after all the crashes and resets, do I still buy Bitcoin?

I called it: "The Fourth Covenant Between God and Humanity.”

The first three major covenants in human history all had one fatal flaw: They were never meant for everyone.

The first was The Old Testament.

It was bound by bloodline, belonging was decided before you were born. If you were not part of the chosen lineage, you were never invited.

The second was The New Testament.

It spoke of love and salvation for all, but history tells the truth words try to hide. If you were a poor Asian farmer in the 17th century, you were never stepping foot inside the cathedral.

Empires stood at the gates. Race, power, and hierarchy decided who was worth saving.

The third was The Declaration of Independence.

This was the birth of the modern world. It promised freedom, equality, and opportunity, but only if you were born on the right land, holding the right passport, inside the right system.

Sure, "freedom of movement" existed in a sense, but the price was too high for most. The odds were brutal. The rules were never written for the common person.

Most never even reached the starting line. They spent their lives proving they were worthy. With money, with education, with obedience, with luck. Layer by layer, they begged the system to let them belong.

Then came the fourth covenant: Bitcoin.

It is the first system in human history that doesn't ask who you are before it lets you in.

It doesn't care about your race. It doesn't care about your nationality. It doesn't care what language you speak or where you were born.

There are no priests, no governments, no borders, and no permission slips. There is only you and a private key.

You don't need to be chosen. You don't need to be connected. You don't need to be approved. You don't prove yourself to Bitcoin. You either understand it, or you don't.

This system doesn't promise you comfort, safety, or guaranteed success. It only offers the one thing humanity has never actually had: Equal access to the same rules, at the same time, for everyone.

For me, this isn't an investment thesis. It isn't a trade, and it isn't a bet. This belief is the only reason I can sit through the tides of the market, enduring the years of silence, the doubt, the ridicule, and the despair, and still hold.

If you've made it this far...

Congrats, you now have the blueprint.

You know how to spot a regime shift, you know how to raise your odds of getting in early with the detective toolkit, and you understand the anchors required to stay grounded.

But if I’m being 100% genuine with you: none of these tools will save you if you can't control the person staring back at you in the mirror.

Everything I’ve shared comes from fragments of my own reflection notes, written across 13 years of surviving cycles, mistakes, and scars. As well as late-night conversations with friends who survived the same fires.

Looking through the rest of my scattered notes, I realize I probably have enough to write an entire book, focusing on a completely different corner of crypto in each different chapter.

But these lessons cannot be "downloaded" overnight, just like the "fast money mindset" can't actually make you wealthy.

I was a stubborn student of the market. I had to learn the hard way. It took me years to carve these lessons into my brain because, back then, there was no manual. You just had to attain that epiphany yourself through the pain.

I’ve watched the “geniuses” of every cycle disappear, not because they weren’t smart, but because they had a fast money brain and a fragile ego. Meanwhile, the ones still pulling wins in 2026, and those who kept their gains and walked away retired, all shared a single realization: The token was never the point.

The point is the sovereign system we are building and the personal discipline it takes to belong to it.

Crypto is the most brutal, honest teacher on the planet. It will hunt your weakest trait, whether it’s greed, impatience, or laziness, and it will charge you a massive "tuition fee" for it. I paid mine in full. My only hope is that this article saves you from paying as much as I did.

If you actually read this from start to finish (without asking AI to summarize), then I really believe you got the potential to become one of the survivors who conquered multiple cycles. You are exactly the type of person who can actually master the skills checklist I gave in Part II.

I truly hope you can become one of my newer "old friends" I can grind with in the next cycle, and the next, and the next next next, as we watch Bitcoin dominate the world.

And to my long-time readers: thank you. Your kindness is the reason I decided to open up my personal notes and share these reflections.

Crypto may suck from time to time, but it is still worth loving, and it is still worth building.

I’ll see you at the next regime shift.

— Pickle Cat